冲刺650万辆?2024年中国汽车出口!

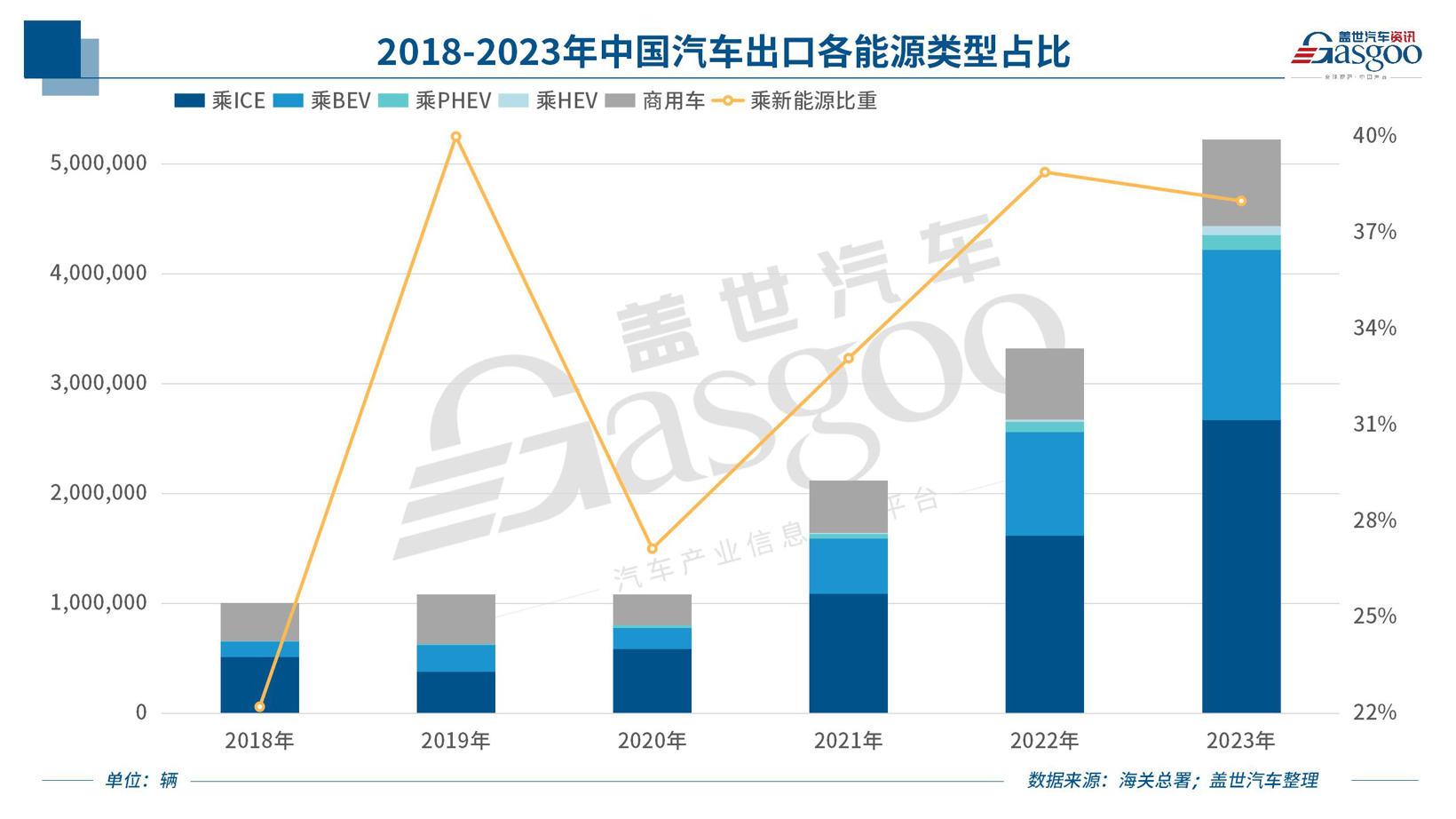

海关总署的数据显示,过去三年,我国汽车出口规模接连取得里程碑式突破:从2021年出口量突破200万辆大关,超越韩国成为全球第三大汽车出口国;到2022年出口量闯入300万辆,超越德国成为全球第二大汽车出口国;再到2023年出口量跨越了两个百万级台阶,达到522万辆,打破了日本连续七年汽车出口第一的成绩,跻身全球第一大汽车出口国。

登顶之后,我国汽车出口最大的敌人实际上只剩下了自己。2024年,中国汽车出口能否继续自我突破、向上攀升?

600万辆 or 650万辆?2024年中国汽车出口将卷至新高

过去几年,中国车企已经在海外建立了一定的产品和技术优势,加上在渠道、研发和产品本地化等各个方面不断增加投资,业内专家认为,在2023年实现56%高增长的背景下,2024年中国汽车出口仍然有一个惯性增长的良好机会。至于增幅如何,出口量具体会达到多少,各机构和专家各有己见。

中汽协会副总工程师许海东表示,鉴于中国汽车产品已经靠产品力征服了国外的消费者,预计2024年出口销量将在2023年的基础上再增加60万辆。

盖世汽车研究院也对2024年中国汽车出口前景持乐观态度,认为今年出口量有望突破600万辆,其中乘用车出口有望达到520万辆。

乘联会秘书长崔东树则更为激进,在他看来,2024年中国汽车出口应该能够达到增长20%,大概在650万台左右的规模上。“中国汽车出口目前来看仍然属于一个持续上行的态势。因此2024年有继续提升的空间。”

图片来源:盖世汽车

不论是550万辆,600万辆,还是650万辆,大家的共识是一样的,即2024年中国汽车出口将在2023年的基础上进一步增长。事实上不止2024年,未来我国汽车出口的发展趋势也很明确。首先从大的国际政治层面,目前我国对俄罗斯、对欧洲、对中南美的关系总体都保持温和平稳的态势,为中国汽车出口创造了良好的国际正经环境;另外人民币的汇率也保持相对平稳的小幅贬值的状态,这对出口来说也比较有利;企业端,由于国内竞争态势“内卷”激烈,加上本身电动化和智能化产品实力加持,车企纷纷将目光投向海外新市场,加码海外出口,将持续为汽车出口贡献增量。

“现阶段全球汽车市场正处于剧烈变化之中,中国汽车有望在世界汽车变局中获得巨大增长机会。”崔东树还展望,我国汽车在全球市场的占比有望从目前的30%提升至50%,甚至60%,随着汽车出口卷至新高,这些并非不可能实现。

燃油车 or 新能源,谁将是中国汽车出口的主要增长力量?

2023年,中国汽车出口量跃居世界第一,传统燃油车作出了巨大贡献。随着我国发动机、变速箱核心动力总成技术跻身世界先进行列、整车设计和制造品质加速提升、智能网联技术创新加速、品牌向上取得新进展,中国品牌燃油车在全球市场的竞争力逐渐凸显。根据中国质量协会“2023年度中国燃油汽车行业用户满意度测评(CACSI)”报告,中国品牌满意度与合资品牌的差距已缩短至1分,产品质量已经达到同级别合资品牌的水平。2023年,我国燃油车出口370.7万辆,同比增长近53%,成为汽车出口的支柱力量。

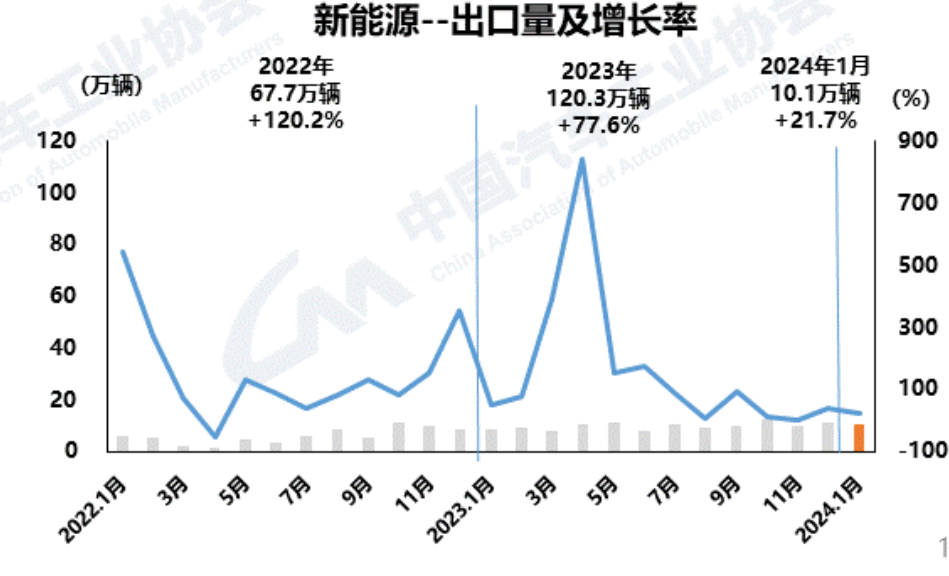

与此同时,2023年出口量跃居全球第一,新能源汽车成为重要增长极。得益于政策与市场“双轮驱动”,我国新能源汽车起步早、发展快,不仅搭建了创新能力强、技术迭代快、有成本竞争优势的完整产业链供应链体系,电动化与智能网联化技术创新和商业模式创新也走在全球前列,这从新能源汽车的销量成绩就能看出。2023年我国新能源汽车产销连续9年全球第一,新能源汽车出口达120.3万辆,同比增长77.6%。

图片来源:中汽协

图片来源:中汽协

那么2024年,传统燃油车和新能源车谁又将成为汽车出口的增长重点呢?对此,崔东树认为,传统燃油车依然是汽车出口增长核心的一个主力,因为目前来看,传统燃油车市场的领域相对是比较广泛的,尤其在俄罗斯、东南亚等市场的表现来看,都呈现出相对较强的增长态势;相比之下,在2023年的第四季度,新能源汽车的出口已经出现同比增长乏力,而传统燃油车的出口依然相对稳定,在中国汽车出口的一些回暖地区,包括前独联体地区、非洲、南美等地区,传统燃油车的需求都比较旺盛。因此,在欧洲市场发展受阻、新兴市场逐步回暖的情况下,传统燃油车的发展相对来说依然是汽车出口重要的组成部分。

当然,至于新能源汽车的增长贡献度,崔东树也并未否认,并且认为会有逐步的提升。“关键在于中国小微型电动车如何有效地做大做强。”崔东树强调。在他看来,现在中国车企特别喜欢做大车,但欧洲作为环保主义者实际上并不需要大车,这种消费的反差使得中国车企在发展新能源汽车出口方面,应在节能环保的基础上,实现满足欧洲和东南亚市场对小型电动车的需求,以及世界其他地区消费者的差异化需求。

盖世汽车研究院分析师陈玮玮则认为,2024年传统燃油车和新能源汽车的出口将保持齐头并进的势头,不过从增速和增幅上来看,新能源汽车的出口增长相对会更大一点。“尽管欧洲对中国电动车展开的反补贴调查可能会在今年下半年造成10%至20%的附加关税,但由于当地市场对新能源汽车的需求仍然旺盛且没有被充分满足,中国新能源汽车出口仍然存在时间窗口机会。另外,东南亚的泰国和印尼都延长、扩大了电动汽车的补贴和激励,在这些因素的综合作用下,新能源汽车出口预计将取得更强劲的增长。”陈玮玮说道。

According to data from the General Administration of Customs, China's automobile exports have achieved milestone breakthroughs in the past three years: from 2021, the export volume exceeded 2 million vehicles, surpassing South Korea to become the third largest automobile exporter in the world; By 2022, the export volume will reach 3 million vehicles, surpassing Germany to become the world's second largest automobile exporter; By 2023, the export volume had crossed two million steps, reaching 5.22 million vehicles, breaking Japan's record of being the top exporter of automobiles for seven consecutive years and becoming the world's largest exporter of automobiles.

After reaching the summit, the biggest enemy of China's automobile exports was actually only itself. Can China's automobile exports continue to break through and climb upwards in 2024?

6 million or 6.5 million vehicles? China's automobile exports will reach a new high in 2024

In the past few years, Chinese car companies have established certain product and technological advantages overseas, and have continuously increased investment in channels, research and development, and product localization. Industry experts believe that despite achieving a high growth rate of 56% in 2023, there is still a good opportunity for inertia growth in China's car exports in 2024. As for the growth rate and the specific export volume, each institution and expert has their own opinions.

Xu Haidong, Deputy Chief Engineer of China Association of Automobile Manufacturers, stated that given that Chinese automotive products have already conquered foreign consumers through product strength, it is expected that export sales in 2024 will increase by 600000 vehicles on the basis of 2023.

The GAC Automotive Research Institute is also optimistic about the prospects of China's automobile exports in 2024, believing that the export volume is expected to exceed 6 million vehicles this year, with passenger car exports expected to reach 5.2 million vehicles.

Cui Dongshu, Secretary General of the China Association of Automobile Manufacturers, is more radical. In his view, China's automobile exports should reach a growth rate of 20% in 2024, around 6.5 million units. "Currently, China's automobile exports are still in a continuous upward trend. Therefore, there is room for further improvement in 2024."

Sprint 6.5 million vehicles? China's automobile exports will reach a new high in 2024

Picture Source: Cover Shi Auto

Whether it is 5.5 million vehicles, 6 million vehicles, or 6.5 million vehicles, everyone's consensus is the same, that is, China's automobile exports will further increase in 2024 on the basis of 2023. In fact, not only in 2024, the development trend of China's automobile exports in the future is also very clear. Firstly, from a broader international political perspective, China's current relations with Russia, Europe, and Central and South America have generally maintained a warm and stable trend, creating a favorable international environment for China's automobile exports; In addition, the exchange rate of the Chinese yuan also maintains a relatively stable and slightly depreciating state, which is also beneficial for exports; On the enterprise side, due to fierce domestic competition and the strength of its electrified and intelligent products, car companies are turning their attention to new overseas markets and increasing their overseas exports, which will continue to contribute to the growth of automobile exports.

"At present, the global automotive market is undergoing drastic changes, and Chinese cars are expected to have huge growth opportunities in the global automotive market." Cui Dongshu also looks forward to the increase of China's automotive market share in the global market from the current 30% to 50%, or even 60%. With car exports reaching new highs, these are not impossible to achieve.

Who will be the main driving force for China's automobile exports, whether it is gasoline powered vehicles or new energy?

In 2023, China's automobile export volume jumped to the top in the world, and traditional fuel vehicles made a huge contribution. With China's engine and transmission core powertrain technology entering the world's advanced ranks, the acceleration of vehicle design and manufacturing quality improvement, the acceleration of intelligent networking technology innovation, and new progress in brand advancement, the competitiveness of Chinese branded fuel vehicles in the global market is gradually becoming prominent. According to the 2023 China Fuel Vehicle Industry User Satisfaction Assessment (CACSI) report by the China Association for Quality, the gap between Chinese brand satisfaction and joint venture brands has been narrowed to 1 point, and product quality has reached the level of joint venture brands at the same level. In 2023, China's exports of fuel vehicles reached 3.707 million, a year-on-year increase of nearly 53%, becoming a pillar force in automobile exports.

Sprint 6.5 million vehicles? China's automobile exports will reach a new high in 2024

At the same time, in 2023, the export volume jumped to the top in the world, and new energy vehicles became an important growth pole. Thanks to the dual wheel drive of policies and markets, China's new energy vehicles started early and developed rapidly. They not only built a complete industrial and supply chain system with strong innovation capabilities, fast technological iteration, and cost competitive advantages, but also led the world in electric and intelligent networking technology innovation and business model innovation. This can be seen from the sales performance of new energy vehicles. In 2023, China's production and sales of new energy vehicles ranked first globally for 9 consecutive years, with exports of 1.203 million new energy vehicles, a year-on-year increase of 77.6%.

Image source: China Association of Automobile Manufacturers

So in 2024, who will become the growth focus of automobile exports for traditional fuel vehicles and new energy vehicles? In this regard, Cui Dongshu believes that traditional fuel vehicles are still a main force in the growth of automobile exports, because currently, the traditional fuel vehicle market has a relatively wide range of fields, especially in markets such as Russia and Southeast Asia, which have shown relatively strong growth trends; In contrast, in the fourth quarter of 2023, the export of new energy vehicles showed weak year-on-year growth, while the export of traditional fuel vehicles remained relatively stable. In some areas where China's automobile exports have rebounded, including the former CIS region, Africa, South America, and other regions, the demand for traditional fuel vehicles is relatively strong. Therefore, despite the obstacles in the development of the European market and the gradual recovery of emerging markets, the development of traditional fuel vehicles remains relatively an important component of automobile exports.

Of course, as for the growth contribution of new energy vehicles, Cui Dongshu has not denied it and believes that there will be a gradual improvement. "The key lies in how China's small and micro electric vehicles can effectively grow and strengthen," Cui Dongshu emphasized. In his view, Chinese car companies now particularly like to make big cars, but as environmentalists in Europe, they actually do not need big cars. The contrast of this consumption makes Chinese car companies need to meet the demand for small electric vehicles in the European and Southeast Asian markets, as well as the differentiated needs of consumers in other regions of the world, on the basis of energy conservation and environmental protection when developing new energy vehicle exports.

According to Chen Weiwei, an analyst at GAC Automotive Research Institute, the export of traditional fuel vehicles and new energy vehicles will maintain a trend of simultaneous growth in 2024. However, in terms of growth rate and growth rate, the export growth of new energy vehicles will be relatively larger. Although the European anti subsidy investigation into Chinese electric vehicles may result in additional tariffs of 10% to 20% in the second half of this year, there is still a time window opportunity for China's new energy vehicle exports due to the strong and insufficient demand for new energy vehicles in the local market. In addition, Thailand and Indonesia in Southeast Asia have extended and expanded subsidies and incentives for electric vehicles, and under the combined effect of these factors, new energy vehicle exports are expected to achieve stronger growth Chen Weiwei said.